This post is sponsored by the American Express Cash Magnet™ Card.

I don’t keep my pennies in a tin can tacked to the closet floor a la Francie Nolan in A Tree Grows in Brooklyn, but it won’t surprise anyone to know that in my home life and my business life, I try not to have many complicated bells and whistles when it comes to my finances.

My bank account is the same one I’ve had since I first opened it the second grade. My credit card is the same no frills one I opened when I left for college and wanted to build my credit (and pay for books). Starting at the age of 16, when I got my first real paycheck from my job serving fried clam strips, I did my own taxes. But running your own business means things get a little more complicated. A few years ago, I hired an accountant to help me with the business side of things. When I admitted that I didn’t keep a separate credit card for business expenses, he looked at me like I had two heads. “Why?” he asked. “That’s like saying no to free money.”

I’m glad to report that I’ve finally changed my ways. At the beginning of the summer, when American Express reached out about their new Cash Magnet Card, I decided to finally change how I run things. The American Express Cash Magnet Card is the company’s new Cash Back Card. It’s designed specifically for folks who value simplicity. Instead of a complicated rewards system, the benefits are simple: unlimited 1.5% Cash Back on your purchases without caps, categories, or an annual fee. Terms apply, learn more here and here.

Before the American Express Cash Magnet Card, credit card rewards systems sometimes confused me. I’m the first to admit that I crave simplicity. At home, I find comfort in clean lines and simple trappings. Give me subtle patterns and calm colors and nothing too fussy. But in work, I admit that my yen for keeping things simple can mean that I sometimes get a bit stuck in my ways. Encouragement from my accountant notwithstanding, I put off opening a dedicated business credit card for years.

As predicted by nearly everyone I talked to, the American Express Cash Magnet Card has been extremely convenient. And it literally pays. I really recommend it for any of you looking to inject some more simplicity into what can sometimes be a complex part of our lives. I could see it being a great way to organize personal spending and simplify your day-to-day life. Think about it: as you spend, you earn simple cash rewards that can go directly back into covering those expenses. (Something that old tin can could never offer.)

And like all American Express Cards, the Cash Magnet Card has the powerful backing of American Express (terms apply – see more here).

All opinions are my own. Thanks so much for supporting the brands that support Reading My Tea Leaves.

33 Comments

I totally agree on wanting simplicity and find all the different categories of benefits tied to credit cards confusing (and well, uninteresting, since what I’m most interested in is getting some $$ back)!

On a complete tanget–could you please share where you got that lovely white linen dress from?

Ha! Yes! Don’t need a subscription to Sports Illustrated…just cold hard cash! My dress was a gift from James from Pyne and Smith!

Erin, while you’re in sharing… would you share the source for your beautiful wallet? 🙂

Wish I had the exact name for you! I found it in a little shop on Broome Street called Top Hat, but not sure who makes it!

I got my first Amex card this summer and have been very pleased with their clear rules, and great customer service. I’d love another post or two about personal finance in your marriage, balancing finance once kids came into the picture, etc… Starting down that track myself after getting married earlier this month, and eager for more perspectives and options.

So glad! I really love their website. Just actually cashed in on my cash rewards this morning. So satisfying and easy to do.

I contemplated responding to the post on your Instagram, but here feels more appropriate. I think the juxtaposition between credit cards and minimalist or simplistic living seems odd.. especially when you rarely write about money outside of encouraging freecycling/upcycling and choosing to live in a small apartment rather than a big house in the burbs. Perhaps more finance posts would make posts like this less jarring? 🙂

At the risk of delving into semantics, I think it’s maybe useful to differentiate between simple and simplistic here! I strive for a simple life, but that doesn’t mean I want to oversimplify things. I’m a parent supporting my family and running a business! Doing this job requires a lot of hard work, resources, and management, and finding financial tools that simplify that work is crucial. It takes regular monthly expenses to run this site and having a simple, secure way to manage those expenses and earn cash back has been great for me. I think there definitely might be room for more financial literacy posts here and I’d love to try to make that happen.

I write about simplifying money habits, and would absolutely love to see more on the topic from you. I think that simple living and minimalism have a direct correlation with most money topics!

Yes to this! I love personal finance and am always eager to read that kind of content on my fav blogs 🙂

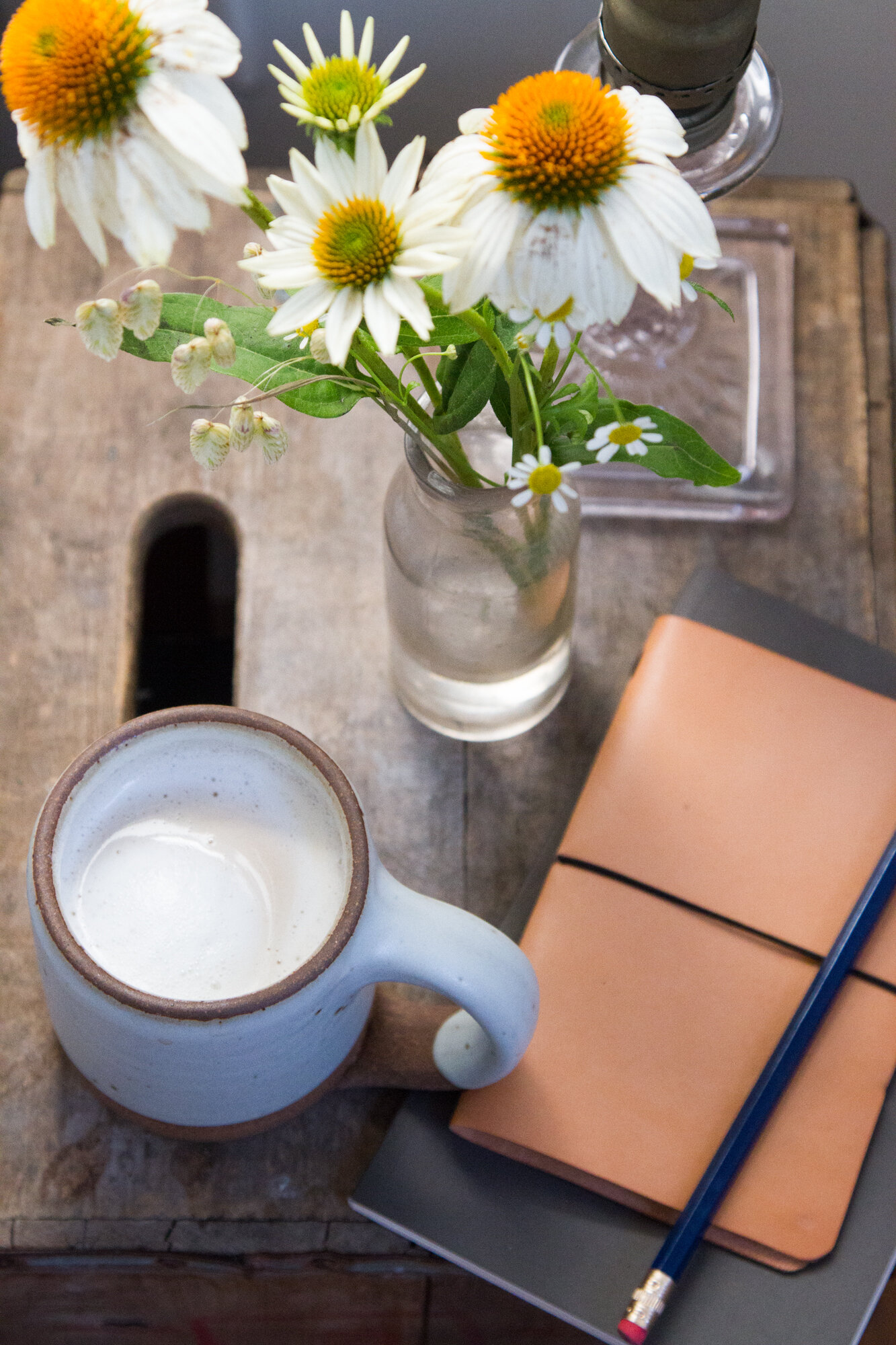

Inspiring me to up my personal finance game! Thanks! And, sources for the beautiful notebooks you use?

The paper one is from Public Supply Company (more in this post: https://readingmytealeaves.com/2017/09/habit-shift-dot-journaling.html). The little leather one was a gift from my friend Abby of Infusion!

another curious reader… ha! where is your beautiful mug from please?

East Fork Pottery!

My simplicity of financial life – no loans and debts. Only debit cards and expenses do not exceed income. Life with loans doesn’t allow me to relax and have fun.

How great! I pay off my credit card monthly, but using it gives me all kinds of benefits—-from being able to keep track of business-related expenses, to having purchase protection and security, to earning cash rewards on the monthly expenses that I need to make to keep this site running!

My debit cards and online banking give the same. But every country and wounded banks has its own peculiarities. Different people – different solutions.

I’ve always refused to get a credit card due to my own irrational fears about debt and my parents’ abuse of them. But my fiancé has always had one, and simply pays it off in full each month, never spending more than he has and building credit and rewards all the while. It’s definitely tempted me to think differently about them.

As for the criticism you’ve received on this post, I’m somewhat baffled. The post seems to be encouraging simplifying and organizing your finances, especially if you run a small business, by maintaining a separate line of credit. I don’t see where it encourages mindless spending or consumerism. Additionally, if the issue is the “sponsored” part of the post, why no similar complaints on clothing posts? I probably shouldn’t overthink it, but it smacks of sexism — you’re free to talk about fashion but not finances?

AMEN Bethany!

It’s totally sexist. The hypocrisy of protesting on this post but not on sponsored clothing posts has me laughing at these commenters. Especially when someone always asks Erin “where did you get X/Y/Z?” on almost every single post (including this one!!!!) Clearly people use the blog and Instagram as a shopping guide. (And thank goodness for that, my Sandgrens are my favorite shoes.) Is AmEx problematic because it’s not as pretty as a dress? Even though the post encouraged financial autonomy and control, rather than purchasing anything? Frankly I don’t understand any complaining about any sponsors on FREE CONTENT, and it’s really clear that sponsors are more highly vetted here than on other writers’ blogs. Erin, I love your blog, it’s kept me sane as a parent, thanks for providing it at no charge to us. As a parent who also has huge student loans and thus huger child care bills to enable two full time working parents I’d love more financial content. Thanks and cheers to you!

Yes! +1 Thank you, Sam!

I am curious about the fact that you got a bank account when you were in the second grade. Could you talk more about that? I get the feeling that you were raised in a Waldorf-style environment and grew up with a degree of simplicity. Was a bank account something your parents encouraged in order to teach you spending/saving? I have a second grader, and I am curious about this. I did not get my first account until I was about to graduate from high school. I wish I had learned better habits as a young person. My mother was a single-mother who worked retail jobs, and wracked up credit card debt to pay for her wants. It took me a long time to recognize that wants and needs are different. I want my children to have a healthier idea of money. Would love to hear more thoughts about this!

Hi there: Yeah! Faye and Silas actually already each have their own bank accounts. We deposit money that they we receive for them as gifts, etc. directly into their respective accounts. In their room, they have a little piggy bank where they put quarters they find, etc. Mostly they dip into it to ride the mechanical horse down the street, but it’s a start to the money conversation! In terms of my own childhood, my mom especially instilled a lot of Waldorfian values in our childhood—especially around play, etc., but I didn’t have a strict Waldorf upbringing. Not sure, honestly, if there are particular Waldorf teachings that would stop folks from talking about money with kids. Maybe? The way I see it, having frank, open conversations about lots of things, money included, is a great way to pave a path toward financial literacy and understanding!

Thank you for taking the time to respond (and so thoughtfully!), Erin! I wanted to ask the same question but Christie beat me to it.

I just read the book The Opposite of Spoiled and it does a great job speaking into these comments about talking to kids about money and providing age appropriate levels of financial responsibility. Highly recommend!

Jess, thanks for the recommendation; I just requested the book from my local library! I grew up in a family that was very financially conscious. We often split “extracurricular” expenses down the middle, joking that I bought the right band shoe and my parents bought the left band shoe. I had a friend who got a credit card at 18 but her parents told she would lose it as soon as she didn’t pay the monthly balance – and she probably still has the same credit card! We are now the ones who manage the finances in our families.

I had AMEX cards for years – one for business and one for personal use – purely for the rewards. However over the last several years their online chat has become useless. I believe it’s due to moving customer service off shore. I’ve cancelled them both and have been very pleased with my Visas from my local credit union.

Sorry to hear that! I’ve had great customer service so far myself. Glad you found a solution that works for you.

First of all, A Tree Grows in Brooklyn is one of my all time favorite books. I used to get mints and put them in paper envelopes and pretend they were penny candy. Although I love and appreciate simplicity in finances, I take a decidedly more complex approach and use credit cards for rewards points for trips. I listened to this podcast called Choose FI and they talk about credit card rewards and it is amazing! We are using it for a free trip to Hawaii for our family and we used it for a free hotel stay in Seattle when we went to see Pearl Jam. If I was to have one card though, I think 1.5% back on everything is great.

Echoing others, I’m baffled by the criticism you’ve gotten on this post. It’s refreshing and encouraging to hear you speak so transparently about financing your life as a parent and business owner. I think you mentioned this on IG, but I’d love to know more about how you and James balance budgeting for childcare (which is SO expensive) and life purchases, especially since you seem to purchase one special, ethically-made (and therefore more expensive) item where others might purchase five mass-produced things. Maybe it’s personal, but I get sticker shock over one well-made item when I might not necessarily get the same knee-jerk reaction if I spend a similar amount on five things…does that make sense? When do you justify purchasing something you like and appreciate, and how do you decide what to allocate towards childcare versus food versus other stuff? (I hope I’m not rambling too much as I cobble my thoughts together…)

It may be entirely beside the point, but the A Tree Grows in Brooklyn reference made me smile.

whole point!

One warning to travellers though, Amex doesn’t always work abroad, Peru, Sweden and Germany are countries where I have had issues with Amex.

Comments are moderated.